🕒 Time Interval Settings

🕒 Time Interval Settings

The Time Interval Settings allow you to precisely define when the strategy should start and how long it should run. This ensures that the trading algorithm remains active only during the specified period, which is especially useful for periodic strategies or strategies tailored to specific market conditions.

📅 Start Date and Time

• Description: The strategy will only activate after the specified start date and time.

• Setting: Choose an exact date and time for the strategy to begin.

• Example: 2024-01-01 08:00 – The strategy starts operating on January 1st at 8:00 AM.⏳ End Date and Time

• Description: The strategy will remain active until the specified time, then automatically stop.

• Setting: Enter the final date and time for the strategy to stop.

• Example: 2024-12-31 18:00 – The strategy stops operating on December 31st at 6:00 PM.🔄 Automatic Restart

• Description: If enabled, the strategy will automatically restart after closing a position. This ensures continuous operation without requiring manual intervention.

• Setting:

• ✅ Enabled: The strategy automatically restarts after closing a position.

• ❌ Disabled: The strategy does not restart automatically; manual intervention is required.

• Example: If a trading cycle ends and “Automatic Restart” is enabled, the strategy will automatically start the next trading cycle.This setting ensures that the strategy operates only within the specified timeframe and can automatically continue after closing a position. ⏱️📊✨

💵 Investment Amounts

💵 Investment Amounts

The Investment Amounts section allows users to define how capital is allocated and the size of investments for each position managed by the strategy. This configuration is key to risk management and optimizing your investment strategy.

🟢 Initial Investment Amount

• Description: The amount invested when the strategy opens a position for the first time.

• Function: Determines the size of the initial capital investment during the first purchase.

• Goal: Establishes a solid starting point for the DCA (Dollar-Cost Averaging) process and ensures a stable foundation for future purchases.

• Example: If the initial investment amount is 100 USD, the strategy will purchase exactly 100 USD worth of assets on the first buy signal.🔄 Recurring Investment Amount

• Description: The amount invested during each subsequent period when the strategy makes additional purchases.

• Function: Allows continuous purchases to reduce the average entry price.

• Goal: Mitigates the impact of market volatility and balances the investment portfolio.

• Example: If the recurring investment amount is 10 USD, the strategy will invest 10 USD each time the purchase conditions are met.📊 Setup Explanation:

1️⃣ Initial Investment Amount: Set the size of the first position based on your risk tolerance and available capital.

2️⃣ Recurring Investment Amount: Define the amount for regular purchases to steadily grow your position throughout the strategy’s operation.🛠️ Recommended Settings:

• For Beginners: Lower values for both parameters to minimize risk.

• For Advanced Users: Higher values for aggressive position growth and faster average price reduction.⚙️ Optimization Tip: Adjust these parameters to align with your trading style and financial goals, ensuring the strategy operates efficiently and effectively. 🚀📈💼

📊 Purchase Frequency

📊 Purchase Frequency

The Purchase Frequency setting controls how often the strategy executes new purchases. This feature prevents overly frequent position expansions, which could lead to excessive exposure or an inefficient investment strategy.

⏱ Interval Between Purchases

• Description: Defines the number of candles (time periods) that must pass between two consecutive purchases.

• Goal: You can set a multi-day investment pace even on a 4-hour chart by specifying purchases every 6 candles. This ensures precise control over the investment process, making the indicator operate more efficiently, accurately, and safely.

• Setting: Enter an integer value representing the minimum number of candles between purchases.

• Example:

• 5: The strategy will wait at least 5 candles before opening a new position.

• 10: The strategy will wait at least 10 candles before making another purchase.📚 Usage Example:

• Goal: Prevent the strategy from opening new positions too frequently, avoiding unnecessary purchases caused by market noise.

• Interval Range: 1–100⚙️ Optimization Tip: This setting helps optimize purchasing decisions, ensuring that the strategy executes well-timed and deliberate purchases, improving both efficiency and overall performance. 📈🤖✨

🛡️ Risk Management

🛡️ Risk Management

The goal of Risk Management is to maintain an optimal balance between risk and profit, minimizing potential losses while maximizing gains. This feature automatically regulates purchases and position closures based on the defined parameters.

📉 Loss Limit

• Description: If the price does not drop below a predefined loss level, the strategy will not execute additional purchases.

• Goal: Effectively reduce the average entry price during periods of loss.

• Function: The strategy monitors the loss threshold and will only continue purchasing if the price drops below the defined limit.

• Setting: Enter the loss percentage (Loss Limit %).

• Example:

• 10%: If the price drops by at least 10% relative to the average entry price, the strategy will allow additional purchases.🎯 Take Profit

• Description: A predefined profit target percentage, upon reaching which the position is automatically closed.

• Goal: Ensure profits are realized before the price reverses.

• Function: If the price reaches the Take Profit target, the strategy will close the position.

• Setting: Enter the Take Profit percentage (Take Profit %).

• Example:

• 5%: If the price reaches a 5% profit relative to the average entry price, the strategy will automatically close the position.📚 Usage Example:

• Goal: Ensure the strategy disciplined adherence to loss limits and profit targets, securing profits and minimizing risks.

• 📉 Loss Limit: 10%

• 🎯 Take Profit: 5%⚙️ Optimization Tip: These settings enable more consistent returns while reducing the risk of significant losses, ensuring a stable and disciplined trading approach. 📊🔑🚀

📈 Dynamic Take Profit (TP) Settings

📈 Dynamic Take Profit (TP) Settings

The Dynamic Take Profit (TP) feature allows the strategy to adapt to market conditions and gradually increase the profit target over time. This optimizes returns, especially for long-term positions. Additionally, the Smart Invest mechanism ensures efficient handling of missed purchases and continuous strategy optimization.

⏳ TP Increase Frequency

• Description: Defines how often (in days) the Take Profit (TP) level increases.

• Goal: Dynamically increase the profit target based on holding time, allowing for higher returns on longer-held positions.

• Setting: Interval can be specified in days (TP Increase Frequency).

• Example:

• Increase the TP level by 1% every 10 days.⚙️ Enable Dynamic TP

• Setting: Can be enabled or disabled (Enable Dynamic TP).

• Example:

• ✅ Enabled: The Take Profit level will increase at every defined interval.

• ❌ Disabled: The Take Profit level remains fixed.🧠 Smart Invest

• Description: The strategy accumulates missed purchases if the market price is above the Loss Limit. When the price drops below the Loss Limit, the strategy executes a single larger purchase.

• Goal: Efficiently reduce the average entry price by leveraging more favorable purchase points.

• Function:

• If the price is unfavorable, daily purchases accumulate.

• When the price drops below the Loss Limit, the strategy executes a single large purchase.

• Setting: Can be enabled or disabled (Enable Smart Invest).

• Example:

• ✅ Enabled: The strategy accumulates daily purchases and executes them at an optimal price point.

• ❌ Disabled: Each daily purchase happens individually.📚 Usage Example:

• TP Increase Frequency: 10 days

• TP Increase Amount: 1%

• Enable Dynamic TP: ✅ Yes

• Enable Smart Invest: ✅ Yes⚙️ Optimization Tip: With this configuration, the strategy dynamically increases the Take Profit target while the Smart Invest feature ensures missed purchases are executed at the most favorable price points.

This approach maximizes profitability and efficiency, adapting seamlessly to changing market conditions. 🚀📊💡

🧠 Smart Invest Logic

🧠 Smart Invest Logic

The Smart Invest Logic aims to optimize the investment strategy by leveraging market movements. The system dynamically manages purchases to reduce the average entry price and utilize available resources more efficiently.

📊 Accumulation of Missed Purchases

• Function: When the market price does not reach the appropriate level for a purchase, the strategy does not execute an immediate buy.

• Operation: Missed purchase amounts accumulate and are executed later as a single larger purchase.

• Example:

• The price does not drop below the Loss Limit.

• The daily purchase amount accumulates until a suitable opportunity arises.🎯 Optimized Purchases

• Function: When the market price drops to a favorable level (e.g., reaches or surpasses the Loss Limit), the strategy executes a single larger purchase.

• Goal: Efficiently reduce the average entry price and make optimal use of the invested capital.

• Operation:

1. The strategy monitors market price movements.

2. When the price hits the predefined level, the accumulated missed purchases are executed in a single transaction.

3. This optimizes the average entry price and improves strategy efficiency.📚 Configuration Example:

• Smart Invest: ✅ Enabled✅ Benefits:

• More efficient average price reduction

• Flexible purchasing logic

• Better adaptation to market movements⚙️ Optimization Tip: This feature allows the strategy to intelligently handle missed purchases and execute transactions at the most favorable price points, maximizing efficiency and profitability. 🚀📉💡

📲 Notification Settings

📲 Notification Settings

The Notification Settings allow users to receive real-time alerts about key events within their strategy. Notifications are customizable and support dynamic data exchange to provide accurate and up-to-date information for automation through Finandy.com.

🛎️ Finandy Buy Signal (PRO)

• 📝 Custom Template: Customizable notification template for buy events.

• 🔔 Enable/Disable: Turn buy notifications on or off.

• Goal: The strategy automatically sends notifications whenever a new position is opened.

• Example:

• ✅ Enabled: Notifications are sent for every position opening.

• ❌ Disabled: No notifications are sent for buy events.📲 Finandy TP Refresh Signal (PRO)

• 📝 Custom Template: Customizable notification template for Take Profit (TP) updates.

• 🔄 Enable/Disable: Turn TP refresh notifications on or off.

• Goal: Automatic notifications are sent whenever the TP level is updated.

• Example:

• ✅ Enabled: Notifications are sent for every TP update.

• ❌ Disabled: No notifications are sent for TP changes.📈 Dynamic Take Profit Logic (PRO)

• 📊 Dynamically Increasing TP Level: The Take Profit level increases dynamically over time based on predefined parameters.

• 🔔 Notifications: The system sends a notification when the TP level is modified or updated.

• 🔄 Dynamic Variable Replacement:

• Position Size: The strategy replaces this with the current position size.

• Take Profit Value: The system replaces this with the current TP level value.Operation:

1️⃣ When the TP level changes, the strategy automatically checks the new value.

2️⃣ A notification is sent based on the configured template, dynamically replacing relevant values.

3️⃣ Users receive real-time updates about these changes.📚 Configuration Example:

• ✅ Finandy Buy Signal: Enabled

• ✅ Finandy TP Refresh Signal: Enabled⚙️ Optimization Tip: These settings ensure that the strategy sends notifications for every key event, providing accurate and up-to-date information flow. 🚀📲

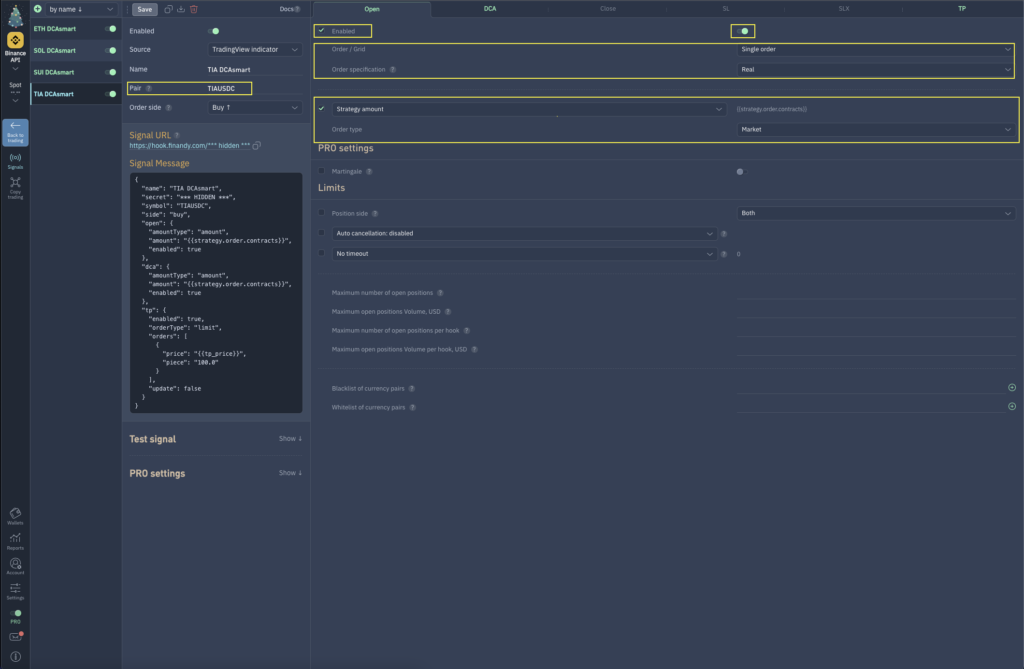

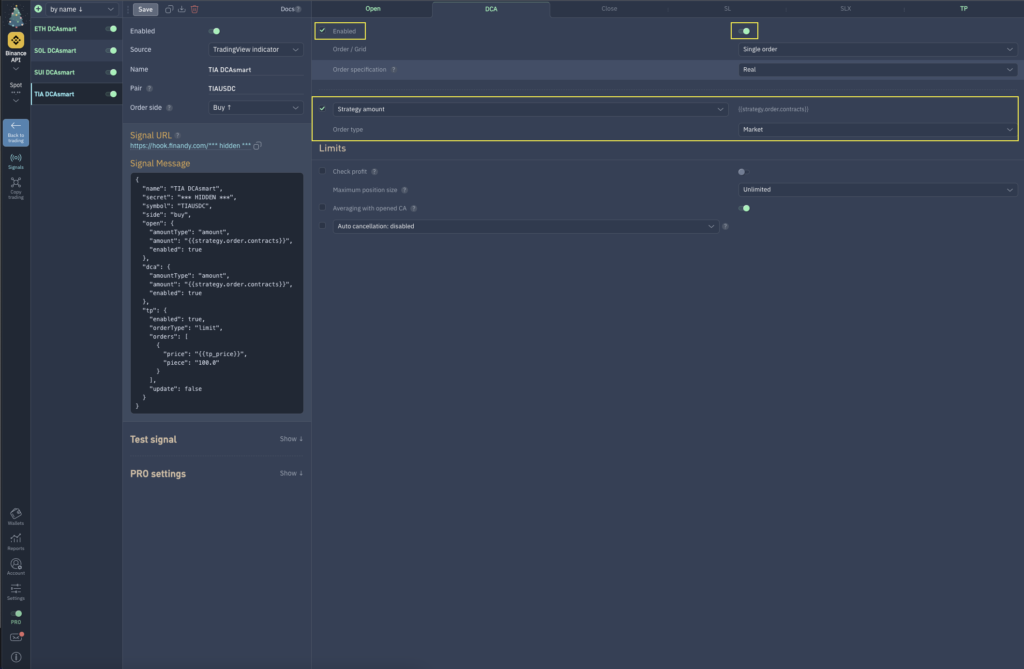

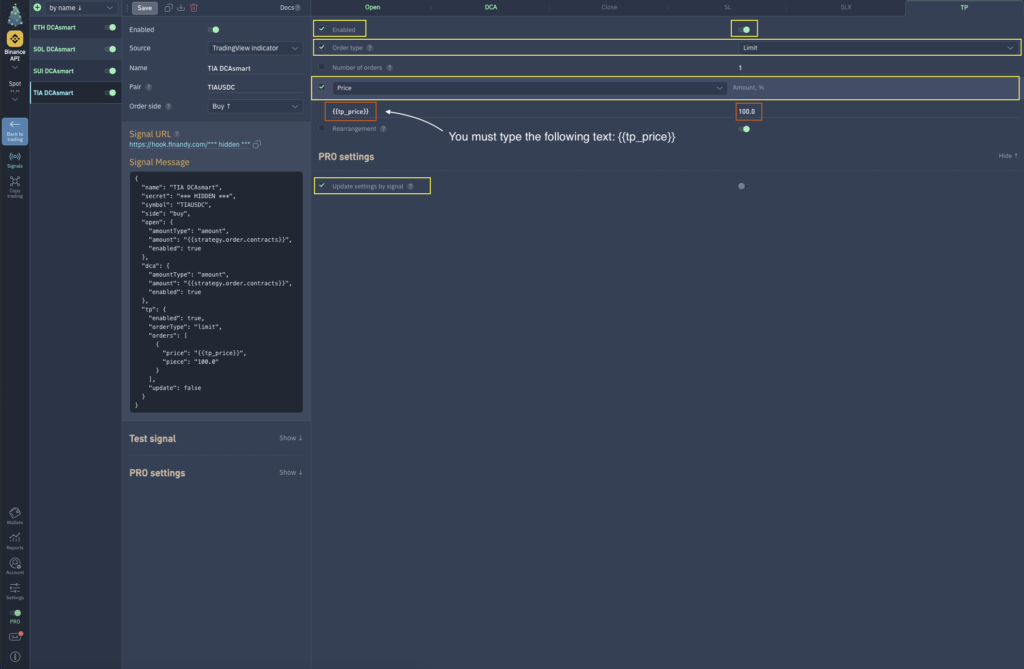

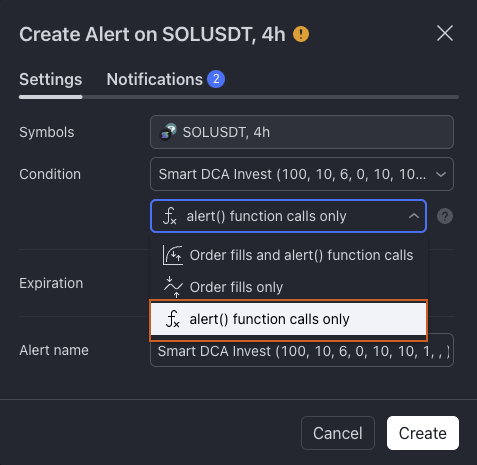

Finandy Setup Step-by-Step:

Ensure these specific features are active on the Finandy Signals interface to guarantee smooth operation and seamless automation. ⚙️📑✨Signal settings: